Once the Purchase Order (PO) is acknowledged and approved by the vendor, they will ship the products to your warehouse or shop, along with the invoice. Understand the key components of cash automation and the significant impact they can have on your business’s operational efficiency. Each of these scenarios requires a nuanced understanding of the double-entry system and the principles of accounting. However, in the case of a quantity discount, it’s adjusted in the bill and the entry is posted net of that in the books. Liabilities, on the other hand, increase on the right side of the equation, so they are credited. The receipt includes a description and the number of items included in the shipment.

Accounts payable reports worth knowing

The accounts payable department should use accrual accounting to post transactions and for financial reporting. If your business is smaller, a bookkeeping employee may handle accounts payable. Creating and managing comprehensive vendor profiles in AP software helps you to access vendor profile information anytime, anywhere with web and mobile apps. You can track the status of deliveries, payment details, contract terms, and purchase invoices in the system.

Journal entry for the purchase of inventory on credit

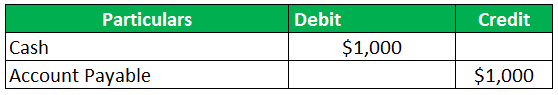

Typical payables items include supplier invoices, legal fees, contractor payments, and so on. A company’s total accounts payable balance at a specific point in time will appear on its balance sheet under the current liabilities section. Accounts payable are obligations that must be paid off within a given period to avoid default. Likewise, the company can make the accounts payable journal entry by debiting the asset or expense account based on the type of goods it purchases and crediting the accounts payable. To record accounts payable, the business needs to pass a journal entry that debits the expense or asset account and credits the accounts payable account.

Reducing Accounts Payables

In this case, the money put on hold in the accounts payable account gets debited and credited back to the return account. A high AP turnover ratio means you’re paying your suppliers quickly, whereas a lower ratio shows that you pay suppliers back more slowly. Most businesses build a report that tracks this ratio every month or quarter to see a trendline, which can provide insight into your cash flow management and financial position. An accounts payable disbursement report is a list of all the entries you’ve created when you process payments to your suppliers. In other words, it shows all payments leaving your AP account over a specified period of time.

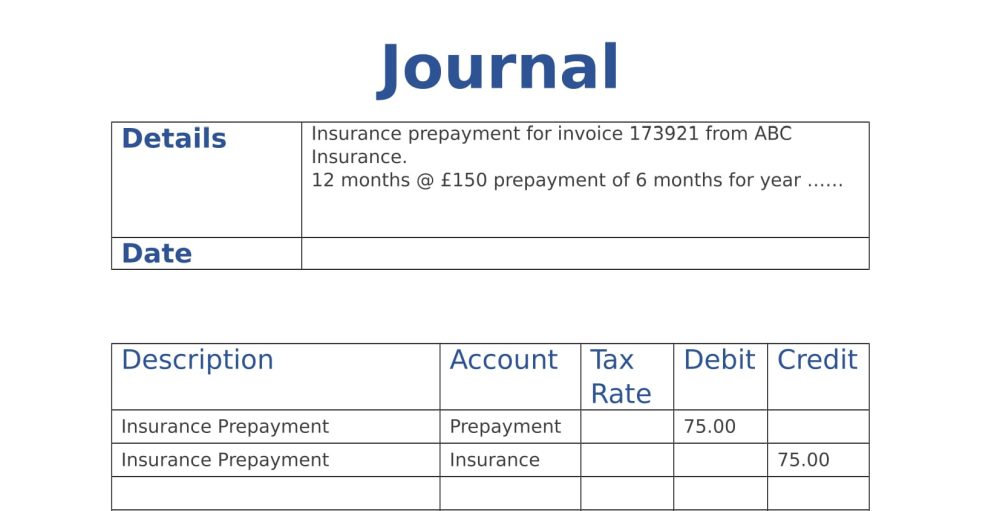

Accounts payable most commonly operates as a credit balance because it is money owed to suppliers. However, it can also operate as a debit once the money is paid to the vendor. The journal entry includes the date, safe harbor accounts, dollar amounts, debit and credit entries, and a description of the transaction. Financial statements also include current assets, which include cash and balances that will be paid within 12 months.

Accounts payable is a general ledger account that showcases the amount of money that you owe to your creditors/suppliers. If yo receive an invoice mentioning the payment terms from your supplier, it then gets recorded in your accounts payable ledger. As a result, your total liabilities also increase with the same amount.

- The former increases the account balance while the other decreases it.

- AP aging reports can be prepared manually or with the help of accounting software.

- The accounting for accounts payable balance falls under the accruals concept of accounting.

The offsetting credit is made to the cash account, which also decreases the cash balance. The accounts payable are the current liabilities that are shown on the balance sheet for which the balances are due within one year. In this case, the company has an obligation to pay suppliers based on the credit term which is usually shown on the supplier invoices. Credit duration in the credit term is usually 30 days, but it can vary depending on the type of business and the relationship between the company and its suppliers. Accounts payable and its management is important for the efficient functioning of your business. As a result, the suppliers would provide goods or services without any interruption.

Instead of canceling the order and voiding the invoice, your supplier reaches out and mentions they can’t fulfill part of the order with a value of $500. Soon after invoicing you, your supplier informs you that they have to cancel the order and will void the invoice. You also need to create what are called adjusting entries in the case of an invoice being changed or voided. If there’s a discrepancy between the two, some money has been unaccounted for. And then it makes the payment of $1,500 to settle this debt on 22 July 2019. Chicago Corporation engaged in the following transactions during the month of January.

You can easily track pending invoices, payment statuses, and overall cash flow, allowing you to make informed decisions quickly. When you think of cash management, your first thought may be to increase collections from accounts receivable. Accounts payable, however, is another major factor in cash management. Below we’ll define accounts payable and how to set up an effective process for accounts payable management. Accounts payable aging schedule shows you the list of all suppliers with the payback period. Also, the aging schedule highlights late payments to avoid late payment charges by vendors.

You can set up a list of favored suppliers, this can promote moderate and favorable buying from your suppliers. This kind of list can be developed considering certain factors, including the supplier’s performance, their financial soundness, brand identity, and their capacity to negotiate. Let’s consider the above example again to understand how to record accounts receivable. Accounts Payable include any debts and obligations the firm owes to third parties on a more immediate timescale.

Once you have reviewed all the received invoices, you can start filling in the invoice details. However, before streamlining your accounts payable process, it is essential to understand what the accounts payable cycle is. The accounts payable cycle is a part of your purchasing cycle, and includes activities essential to completing a purchase with your vendor. A furniture company purchased raw materials from a manufacturer on credit on 22nd August 2023. The company received an invoice from the manufacturer after the delivery of raw materials on 24th August 2023. The invoice states that the outstanding amount of $150,000 will be paid to the vendor before the due date of 1st September 2023.