Cost accounting systems aim to work out the cost of producing goods and services soon on completion and not long after production. Cost accounting enables a business not only to ascertain what various jobs, products, and services have cost but also what they should have cost. It locates losses and wastages, thereby helping to avoid them in the future. Cost accounting calculates costs by considering all factors that contribute to the production of the output, including both manufacturing and administrative factors. Significantly, costing not only enables managers to ascertain costs, but it also provides a basis for ascertaining the profitability of the product being produced or any services rendered. Cost accounting is helpful because it can identify where a company is spending its money, how much it earns, and where money is being lost.

Cost Accounting FAQs

It also helps you make informed decisions when it comes to adjusting your selling prices, switching suppliers, and tweaking your bills of materials or recipes. Generally, the method of costing in commerce refers to a particular system of cost ascertainment and cost accounting. Each industry in the market differs in its nature, in the products they produce and sell, and the kind of services they offer. Hence, different types of methods of costing are utilized by various different industries in the market. Job costing and process costing are the two main types of basic methods involved in costing.

Choosing the best production costing methods for your business

It is not a separate method of costing but is usually designed by trade associations to ensure control over members. In addition to the different costing methods, various techniques are also used to find out costs. Hence, the process cost per unit in different processes is added to find out the total cost per unit at the end. Process costing is often found in such industries as chemicals, oil, textiles, plastics, paints, canneries, rubber, food processors, flour, glass, cement, mining and meat packing. The basic principles of ascertaining costs are the same in every system of cost accounting.

Activity-Based Costing (ABC): Method and Advantages Defined with Example

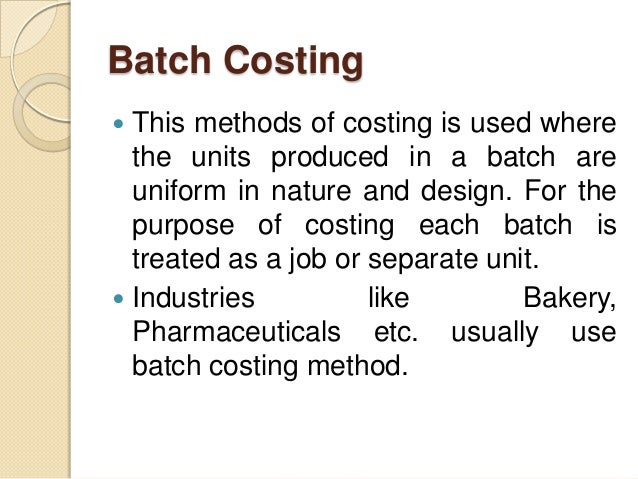

- Batch costing is generally followed in general engineering factories which produce components in convenient batches, biscuit factories, bakeries and pharmaceutical industries.

- Still, it may not provide a complete picture of the company’s true costs and profitability.

- This method is applicable to steel production bricks, mines and flour mills etc.

- In this method, productions of identical products are arranged in convenient groups or batches.

- Once that’s done, you need to allocate a portion of these costs to every activity.

As various components differ from each other in a variety of ways such as to price, materials used and manufacturing process, a separate how to professionally ask for payment from clients template is employed in respect of each component. It is multiple costing in the sense that more than one method of costing is employed. If a product passes through different stages, each distinct and well-defined, it is desired to know the cost of production at each stage. In order to ascertain the same, process costing is employed under which separate account is opened for each process.

Cost-center accounting

When you utilize this system, you can better understand your business expenses and financial health. The right costing method for your business allows you to set pricing effectively and manage budgets with ease. Choosing the right costing method for your business can solve the “inventory management” problem that many manufacturers face. By tracking labor and material expenses, the software helps you accurately determine the cost of each manufactured item. This information empowers you to evaluate profitability, identify cost-saving opportunities, and make data-driven decisions to optimize your operations. Activity-based costing (ABC) is a costing method that directly ties all overhead and indirect costs to specific products and services.

Individually assessing a company’s cost structure allows management to improve the way it runs its business and therefore improve the value of the firm. Cost accounting focuses on a business’s costs and uses the data on costs to make better business decisions, with the goal of reducing costs and improving profitability at every stage of the operational process. Financial accounting is focused on reporting the financial results and financial condition of the entire business entity. Fixed costs do not vary with the number of goods or services a company produces over the short term.

There are three more methods which are also based on the principles of Process Costing but varying slightly due to their special features. For this reason a combination of different costing methods, called composite or multiple costing, is applied. It is a method of costing used to ascertain the cost of executing a work involving heavy expenditure and extending over a long period of time.

There are several key methods of costing, each suited to different types of manufacturing processes. Actual costing calculates costs based on the actual expenses incurred during production, while standard costing uses predetermined costs as benchmarks to compare against actual costs. Activity-Based Costing (ABC) assigns costs based on specific activities that drive expenses, making it useful for complex production processes. Job costing tracks costs for individual jobs or orders, making it ideal for custom manufacturing. A costing methodology known as “activity-based costing” is a method of comparing costs based on the cost of goods and services. It links a manufacturer’s resources and activity to its goods and/or services as it pertains to cost consumption.

However, the methods of analysing and presenting the cost may vary from industry to industry. The method to be used in collecting and presenting costs will depend upon the nature of production. Look at both the obvious costs, like software and training, and the less obvious benefits, like better cost control and smarter decision-making. Write down where you might save money or gain efficiency compared to what it will cost to implement the method.